Section 148

Section 148 of the Income Tax Act 1961 gives authority to the Assessing Officer to send notice to a taxpayer whose income has not been properly assessed. This implies that if the Assessing Officer suspects that a taxpayer has not disclosed complete income or has provided an inaccurate representation of it, officers can commence proceedings under this section.

Section 148 Notice is a notice issued by the income tax officer to reassess the taxpayer's income tax return (ITR) if they disagree with the taxpayer's assessment and believe that some income has not been properly assessed.

Replying to notice Section 148

The key thing to bear in mind is to not to take the notice lightly. In case you receive the notice under section 148, please follow the below pointers:

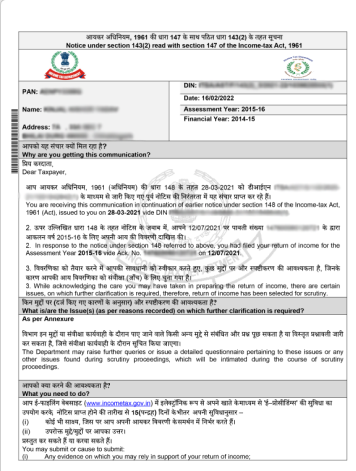

1 : Firstly, check the notice for reasons to believe which are recorded by the assessing officer for issuing the notice under section 148. If the notice doesn’t include the reasons, then you could request the assessing officer to send a copy of the recorded reasons..

2 : You will need to respond to the notice within the given time frame, which is usually 30 days. You can respond to the notice either by filing a return or by providing a written reply to the Assessing Officer along with all the details and proofs.

3 : In case you’re satisfied with 'reasons to believe' which was recorded by the assessing officer, file the return at the earliest. In the case already filed, send the copy to the assessing officer.

4 : In case you’re filing the income tax return in response to notice issued under section 148, ensure that you file it after performing proper due diligence that you declare all your income and expenses carefully. In case you miss reporting any of your income correctly then it could result in unnecessary penalties.

5 : If you believe that the notice served is not valid or reasons provided by the assessing officer for opening assessment under section 147 aren’t valid, then you could challenge the validity of such notice before the assessing officer or higher authorities.

6 : In case you win your case, the Court would halt your assessment proceedings. However, in case the decision doesn’t go in your favour, then the assessing officer could proceed with the reassessment.

Reply to Section 148 Notice Complete Guide

Understanding your duties, rights, and how to respond properly to avoid penalties

Section 148 of the Income Tax Act plays a crucial role in India's tax administration system. If you've received a notice under this section, it likely means the Income Tax Department believes that some of your income has escaped assessment. Understanding your duties, rights, and how to respond properly is essential to avoid penalties or legal trouble.

📋 What You'll Learn:

- What is Section 148?

- Time limits for notices

- Why you may receive a notice

- Authorization requirements

- How to respond correctly

- Consequences of ignoring

- Your rights & responsibilities

- Expert guidance

What is Section 148 of the Income Tax Act?

Section 148 allows the Income Tax Department to reopen past income tax assessments if it has “reason to believe” that income chargeable to tax has escaped assessment for any previous year. Essentially, it's a second look at your financial records — usually due to red flags, high-value transactions, or discrepancies.

Key Point: This process is governed by Section 147 to Section 151, which deal with income escaping assessment and the procedure for reassessment.

Time Limit to Issue a Notice Under Section 148.

As per the latest amendments under the Finance Act 2021, the timelines for issuing a notice under Section 148 are:

Within 3 years from the end of the relevant assessment year if the escaped income is below ₹50 lakh.

Up to 10 years if the AO has evidence that income of ₹50 lakh or more has escaped assessment.

Important: Prior approval from the specified authority is mandatory before issuing such notices.

Why Do You Receive a Notice Under Section 148?

There are several reasons why the Income Tax Department may issue a notice under Section 148:

High-value transactions not reported in ITR (e.g., property purchase, bank deposits, stock market transactions)

Mismatch in income details with data available through AIS or Form 26AS

Non-filing of ITR despite having taxable income

Information received from third-party sources or during surveys/raids

Mistakes or omissions in previously filed returns

Who is Authorized to Issue a Notice Under Section 148?

Only an Assessing Officer (AO), having valid jurisdiction over your case, is authorized to issue a notice under Section 148. However, before doing so:

The AO must conduct an inquiry under Section 148A(a) (if applicable)

A show-cause notice under Section 148A(b) is usually issued first, asking why reassessment should not be made.

The AO must take prior approval from a higher authority like the Principal Commissioner or Commissioner of Income Tax.

How to Respond to the Notice Received Under Section 148?

Here's how you can effectively respond:

Don't panic – but don't ignore!

Read the notice carefully

Gather all relevant documents

Consult a qualified CA

File return or submit explanation

Respond to follow-up queries

At Smart Tax Idea, we assist clients in drafting professional replies and compiling all necessary paperwork to ensure a compliant and effective response.

What if the Assessee Does Not Furnish an Income Tax Return?

If the assessee fails to file a return in response to a Section 148 notice:

Duties and Rights of the Assessee After Receiving a Notice Under Section 148

Duties

File the return/revised return promptly

Cooperate with the Assessing Officer during inquiry

Submit all required documents truthfully

Respond to all notices and summons

Rights

To receive a copy of the “reasons recorded” for reopening the assessment

To challenge the notice if it’s invalid or beyond the permissible time limit

To approach the High Court by filing a writ petition in case of unlawful reassessmen.

To seek representation through a CA or authorized tax expert

Conclusion

A notice under Section 148 is a serious matter, but with timely and professional handling, it can be resolved smoothly. Whether it’s due to a simple oversight or a complex mismatch, expert tax consultation can make all the difference.

Need help responding to a Section 148 notice?

Get in touch with our team at Smart Tax Idea for end-to-end guidance — from drafting replies to representing your case before the department