NGO Registration

NGO registration is a profit that enables Nonprofit organisations to provide services to the public, often with the support of the government, corporations, individuals, or groups. It's crucial for NGOs to comply with policy while serving the majority as a nongovernmental organisation. An NGO is a non-governmental organisation that works to improve society at large through philanthropic endeavours. Depending on the activity you want to pursue, you can start it as a Trust, a Society, or a Non-Profit Company [Section 8 Company].

Document Required

- Memorandum of Association (MOA).

- Articles of Association (AOA).

- Company's name for the approval

- Aadhar Card / Voter ID

- Address proof of the office that is water bill, electricity bill, or tax receipt

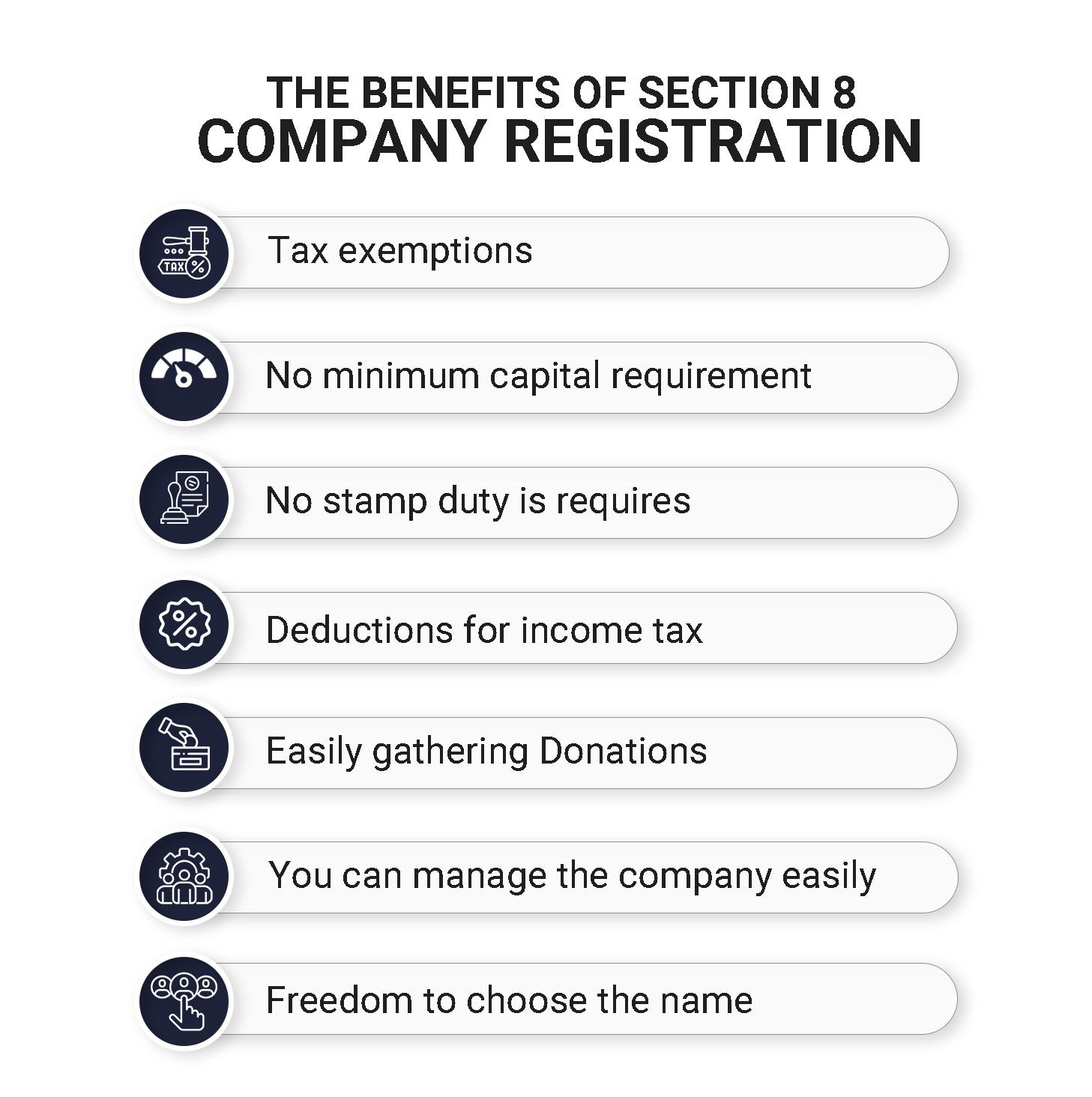

Section 08 Foundation

An organisation may be established as a Trust, a Society or a Section 8 Company. Bear in mind that these are not the same. They have different purposes and uses depending upon what you intend to achieve through the establishment of the organisation.

Not all companies have objectives of making profits by carrying out trade and commerce. Many companies primarily have charitable and non-profit objectives. Such entities are referred to as a Section 8 Company because they get recognition under Section 8 of Companies Act, 2013. These companies dedicate all their incomes and profits towards the furtherance of their objectives.

Form no. INC – 13 : Company’s Draft Memorandum of Association (MOA) and Articles of Association (AOA) in Form No. INC – 13 (as specified in Act) along with the affixation of subscribers’ photographs.

Form no. INC-14: A Declaration is to be affixed in Form no. INC-14 that the draft MOA & AOA are compliant with the provisions & norms of Section 8 and the requirements as per Section 8 have been duly taken care of.

Form no. INC-15: A declaration in Form No. INC-15 on stamp paper & notarized by each member of the company who is applying.

Form no. INC-9: Form no. INC-9 form first directors as well as each subscriber, on the relevant State’s stamp paper and appropriately notarized.

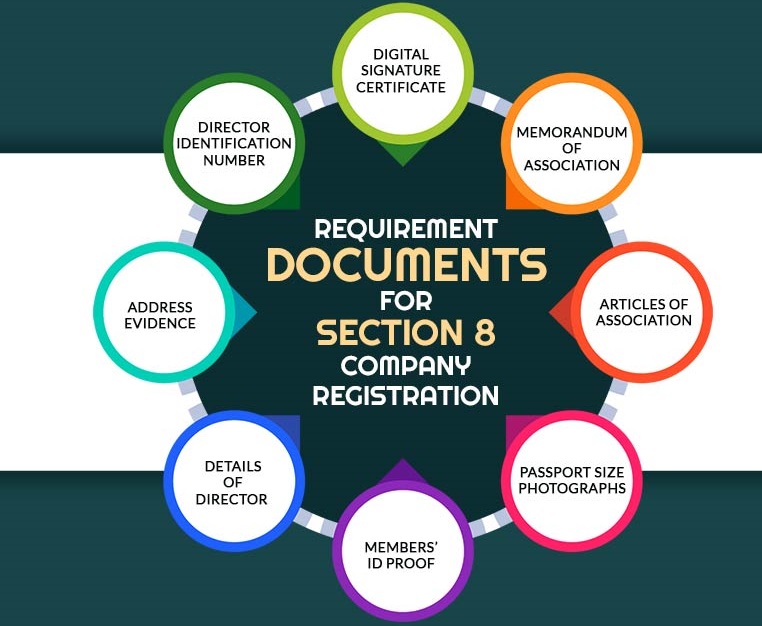

Document Required

- Digital Signature Certificate

- Memorandum of Association

- Articles of Association.

- Passport Size Photographs

- Members’ ID proof such as Aadhar Card, Passport, Voter ID

- Details of Director (When the Members Are Other Companies/LLPs)

- Address Evidence

- Director Identification Number

Trust Registration

Anyone can create a trust in India. The Indian Trust Act, 1882 ('Act') governs the private trusts established in India. This Act is applicable to the whole of India. But, it does not apply to the Waqf, mutual relations of the members of an undivided family determined by any customary or personal law and religious or charitable endowments. Public Trusts in India are usually governed by state-specific legislation, such as The Maharashtra Public Trust Act, 1950.

Private Trusts : A private trust is for a closed group. In other words, the beneficiaries can be identified. Eg: A trust created for the relatives and friends of the author.

Public Trusts : A public trust is created for a large group, i.e. the public in large. Eg: Non-Profit NGO’s Charitable Institutions for the general public..

Document Required

- Trust Deed: A Trust Deed with the appropriate stamp value.

- Utility Bill

- Identity proofs

- No Objection Certificate (NOC)

- Photos of the members

- PAN card / Photographs

- Authentication from Partners

Co-operative Registration

A society is formed when a group of people comes together for a common purpose or a charitable cause. A minimum of seven people is required to form a society. And these societies are governed by the ‘Societies Act, 1860’. The rules and regulations for these may slightly differ from State to State.

Document Required

- PAN Card. All Director and Shareholders.

- Electricity Bill. Latest.

- Aadhaar Card. All Director and Shareholders.

- Bank Statement. All Director and Shareholders.

- Farmer Certificate. All Director and Shareholders.

- Registered Office Address Proof.

- Telephone Bill. or gas bill